Struggling with European VAT sales tax complexity?

Focus on growth – let us sort your tax compliance

Taxmatic gets rid of manual tasks, to ensure your business remains fully VAT compliant across Europe.

Focus on growth – let us sort your tax compliance

Combine scale and security with a modern Cloud-based technology platform, that integrates with your online eCommerce store. Taxmatic technology gets rid of manual tasks to ensure your business remains fully VAT sales tax compliant in all member states of the European Union, and the United Kingdom.

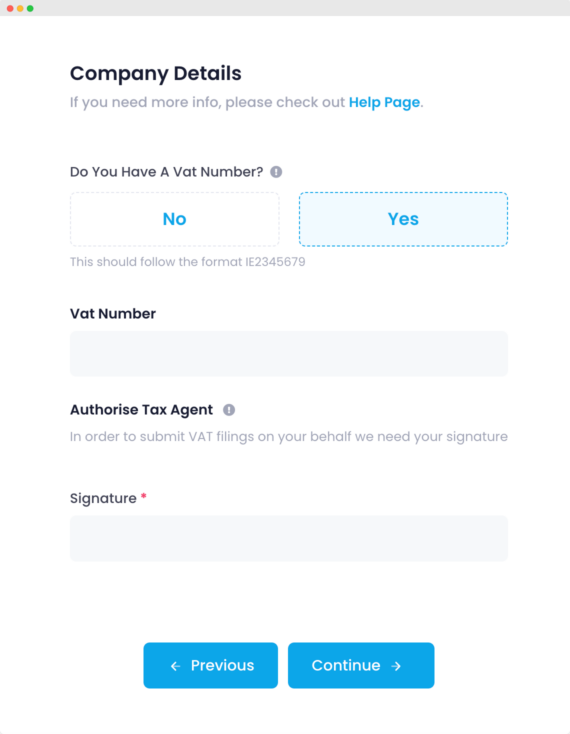

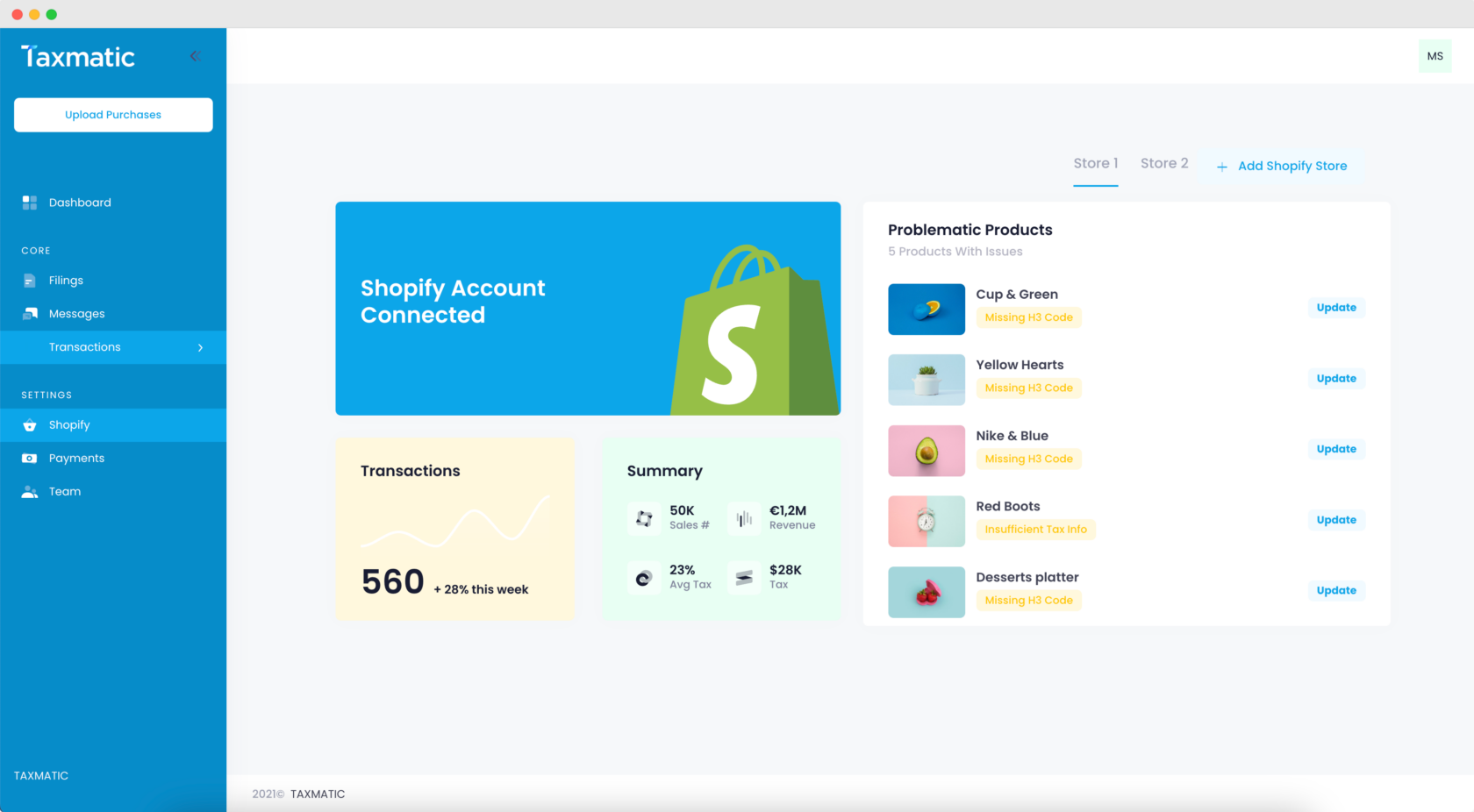

Connecting your online store data

Click to install our connector app or use our secure API connection to hook up sales order data from your online store directly to Taxmatic. This is a READ ONLY connection. Taxmatic does not make edits to any of your data.

Connector apps or Open API apps are available for all major ecommerce store platforms including Shopify, WooCommerce and Magento.

Avoid any manual uploads, data checks or reformatting which can result in errors and gaps in information.

No manual interventions required

It all starts with your customer. Taxmatic connectors access sales order data instantly from your Shopify store. Tax rates, product classifications and total filings per tax period are computed and submitted directly to relevant tax authorities on time. The service implements all changes to VAT rate or product classification codes associated with your products, with no manual interventions required.

Checking your messages

When you have questions or need more information as your business grows, Taxmatic integrates a messaging system for faster resolution and improved record keeping to resolve recurring queries and support with any future VAT audits by European tax authorities.

A click away from growth

Taxmatic tightly integrates with your online store to simply calculate and file returns in all your European markets.

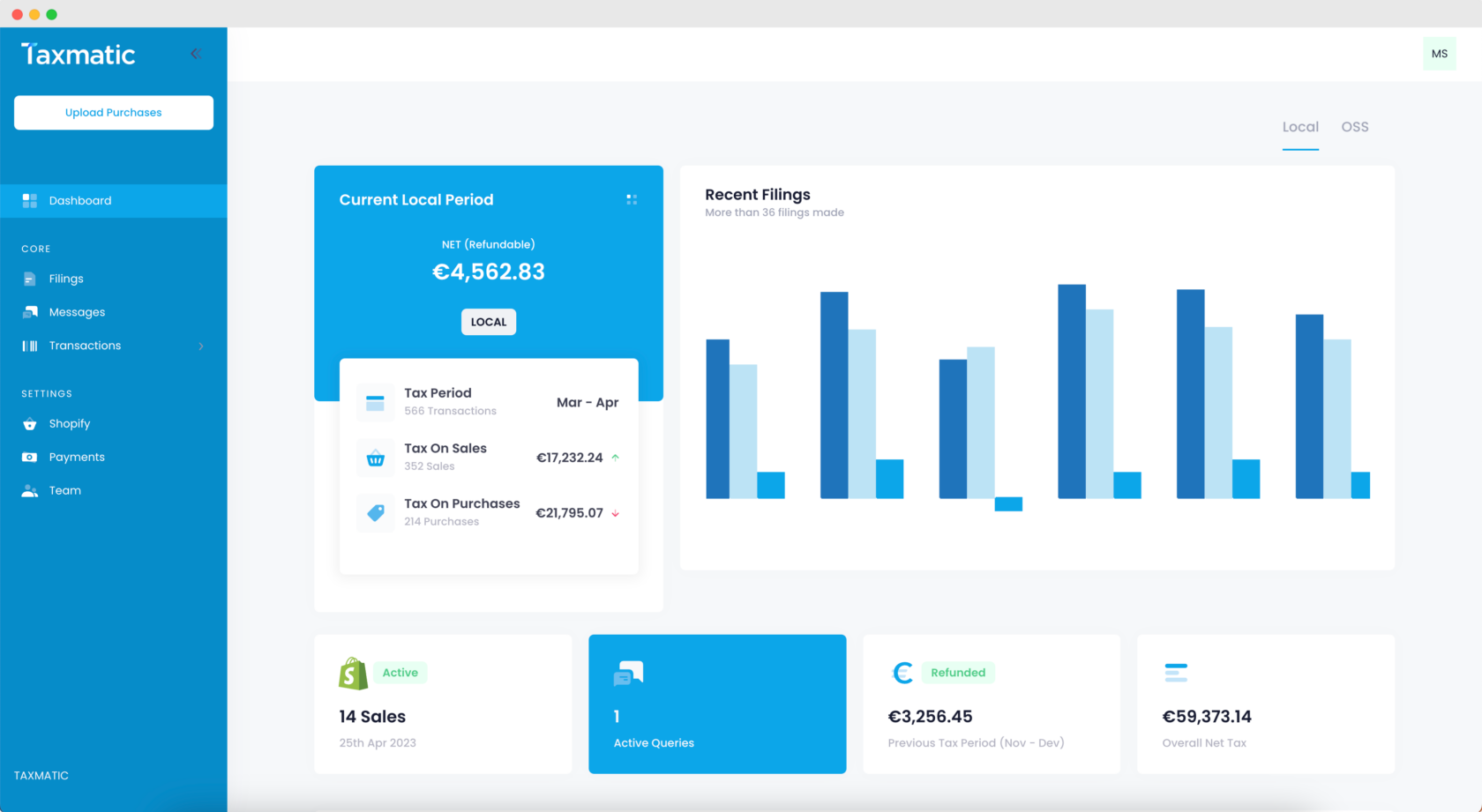

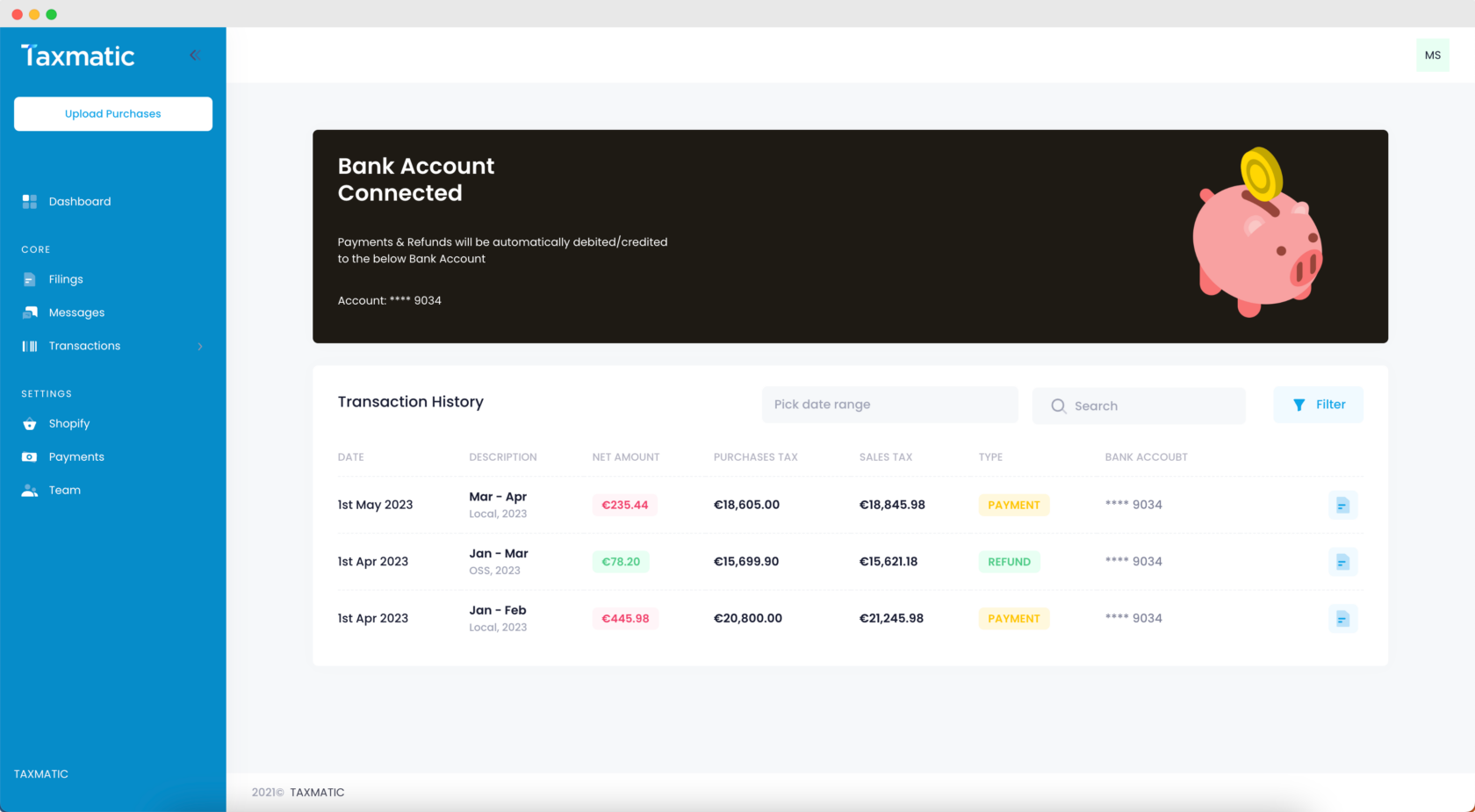

Completing your filings

Never miss a beat with Taxmatic Dashboards and Reports

Keeping eyes on the status of your European VAT sales tax compliance is clear and easy. Reports give quick drill down options to view filing details or remittances by sales order. Dashboard views can be customised for executive reporting, to enable transparent compliance monitoring, and to allow for future growth planning and expansion of your eCommerce business.