One Stop Shop (OSS)

The OSS scheme simplifies VAT compliance for businesses selling goods and services across EU member states. It allows businesses to report and pay VAT for all EU sales through a single OSS VAT return, eliminating the need for multiple VAT registrations in different countries.

Benefits of the OSS VAT Scheme:

Simplified VAT Reporting: File a single quarterly VAT return for all EU sales, avoiding multiple country registrations.

Cost Efficiency: Reduces administrative costs by eliminating the need for local tax representatives in each country.

Improved Cash Flow Management: A clear, centralized process makes it easier to plan and manage VAT payments.

Compliance Made Easy: Minimizes the risk of errors with consistent, EU-wide reporting standards.

Greater Business Reach: Supports cross-border growth by removing VAT-related barriers, enabling seamless international sales.

The Taxmatic platform is the perfect solution to automate your OSS VAT filings, through its smart integration capabilities to robust rules engine, Taxmatic can handle multiple registrations through its platform to enable you to focus on growing your business.

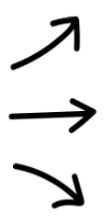

Connect your online store or platform with Taxmatic to calculate, file and pay your OSS VAT.

Online Store Fulfilling

from Ireland

EU Orders Placed

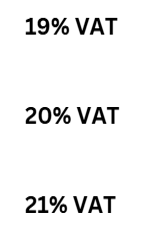

Country VAT Rate Applied

EU Wide OSS VAT

Filing & Payment

FAQ

Who can use the OSS scheme?

Brands who fulfil EU D2C orders from within the EU.

Is registration for OSS mandatory?

No, it’s not mandatory, however is a simplification measure which can be availed of to avoid multiple VAT registrations.

Can a non-EU business use OSS?

Yes, where they hold inventory in an EU warehouse.

Can I register for OSS in any EU country?

Usually, the registration is the country where you hold your inventory.

What happens if I am already VAT-registered in multiple EU countries?

You can potentially deregister in some countries and only have a registration in one country.

How do I file my OSS VAT return?

Taxmatic can assist with OSS filings.

Can I use OSS for B2B sales?

No, OSS scheme cannot be used for B2B sales.

Can I use OSS for both goods and digital services?

Yes, OSS can be used for goods and services sold direct to consumers.

Is the VAT rate based on my country or the customer’s country?

Based on the country of the customer (Where the goods are being delivered).

Can I claim VAT refunds through OSS?

No, only VAT on sales is reportable on OSS.

Do I need to submit invoices under the OSS system?

No invoices need to be submitted under the OSS scheme. Only in the event of an audit would invoices need to be provided.

What happens if my customer returns a product after I have reported the VAT?

Any refund or returns can be reported in the period they occur, to reduce the VAT liability.

Trusted by